| Mr K K Pahuja President ISSDA (Indian Stainless-steel Development Association) |

ISSDA, founded in 1999, is a not for profit organization committed to the growth and development of stainless-steel industry in India. It was formed with the explicit objective of diversifying the applications of stainless-steel in India and increasing usage volumes in the country. Mr K K Pahuja, the head of the Association, details the trends of stainless-steel consumption and its applications.

Civil Engineering & Construction Review: ISSDA has been working towards diversifying the applications of stainless-steel in India and increasing usage volumes in the country. What benchmarks has the organisation established? What milestones has it achieved?

K K Pahuja: Indian Stainless-steel Development Association’s (ISSDA) journey began with the goal of expanding the scope of stainless-steel applications in India; thereby, increasing its consumption. ISSDA recently celebrated its 30th foundation anniversary and chronicled a milestone moment as India achieved 2.5 kg per capita stainless-steel consumption in 2019 against 1.2 kg in 2010, registering an increase of over 100% in a period of just eight years. Today, India is the second largest producer and consumer of stainless-steel in the world with a total production of 3.92 MMT (for CY 2019). The exponential increase in stainless-steel consumption in the country was possible due to the extensive efforts of ISSDA and its members in fields of R&D and process development.

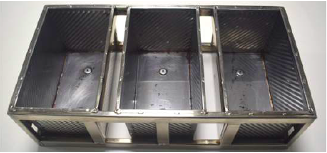

Recently, ISSDA was recognized by the International Stainless-steel Forum (ISSF) for developing innovative product applications in stainless-steel like bread moulds, e-rickshaws, fish cages, and a stainless-steel display van. This is also a testimony to the fact that stainless-steel applications in India have grown beyond traditional applications like kitchenware and tableware. Today, Indian stainless-steel products mirror the benchmarks of world class products and are being exported to critical markets like United States and European Union. ISSDA, along with the government agencies like BIS, has been successful in standardizing stainless-steel products and their respective usage. With key manufacturers as its members, ISSDA is emphasizing on the grass root level for skill development of fabricators and is also imparting hands-on training for selection of appropriate stainless-steel grades.

In the last three decades, the Indian infrastructural landscape has witnessed a vast transformation with stainless-steel increasingly being adopted for modern public applications. This includes railway bridges, foot over-bridges, benches, water coolers, bus stands, sinks, elevators, hand rails, gates, roofing, facade cladding, street furniture and sculptures, public dustbins, etc. Apart from this, mass transit infrastructure like airports, railway stations, subway stations, gateways, and transportation; structural applications like flyovers and bridges; heavy machinery and process industries are all relying on stainless-steel for a sustainable and longer life.

ISSDA has worked with the Indian government and has effectively advocated for the low life cycle cost of stainless-steel, which is now being mandated by the government across infrastructural projects. Apart from this, stainless-steel stands the sustainability test as it is ~100% recyclable and has minimal carbon footprint. Moreover, a longer life and an impressive end-of-life value are the two key parameters now being considered by architects and engineers for new project execution.

CE&CR: India ranks among the top 15 countries in the world in terms of per capita consumption of stainless-steel. Which sector has exhibited the maximum demand?

K K Pahuja: An increased per capita consumption of stainless-steel is the result of increased acceptance of the metal across diversified applications like Automobiles, Railways and Transport (ART); Architecture, Bridges, and Construction (ABC); process industry, pipes and tubes, and hollowware or white goods segments. However, hollowware segment continues to hold the lion’s share of stainless-steel demand in India, ranging between 40-45%. This includes tableware, kitchenware, cutlery, sinks, stoves, utensils, and similar products. The expected growth rate in this segment is nearly 7%. The share of this segment a decade ago was nearly 70%.

With a share of over 14% in the country’s stainless-steel demand, ABC (Architecture, Building, and Construction) sector is another major contributor in the per capita consumption of stainless-steel. Along with major projects like smart city development and highway construction, the sector also comprises applications like railings and gates, furniture (benches, chairs, tables, doors handles), decorative items (ornamental pipes & tubes, metal handicrafts), facades, etc., which are increasingly gaining prominence. This segment is now expecting a thrust, given the government’s renewed focus on infrastructure under the new National Infrastructure Pipeline (NIP), comprising projects like redevelopment of railway stations, metro projects, among other infrastructural developments. Stainless-steel reinforcement bars are also being explored in the construction sector.

Fish Rearing Cage in Stainless Steel

CE&CR: Though India’s stainless-steel consumption level has reached 2.5 kg/capita in a short span of time, the domestic stainless-steel industry faces several challenges. Kindly shed some light on them, along with the suggested government measures to boost domestic manufacturing.

K K Pahuja: An international sentiment of trade protectionism has increased the dumping of stainless-steel products in India; be it United States’ section 232 or protectionist measures put up by the European Union. Additionally, the existing Countervailing Duty (CVD) and Anti-Dumping Duty (ADD) enforced by the Indian government on imports have been ineffective, with imports being on a consistent rise (as seen in the table below).

Source: Department of Commerce

Moreover, the existing ADD and CVD have led to a trade diversion via Free Trade Agreement (FTA) countries, specifically from ASEAN countries as shown in the table:

Source: Department of Commerce (figures in MT)

Consequentially, the domestic stainless-steel industry is bearing the brunt of under-priced imports and is operating at a mere 60-70% of its total installed capacity.

Apart from this, an import duty of 2.5% on key raw materials like Ferro-Nickel and stainless-steel scrap further pushes the input cost for the domestic players, distorting the model of a level-playing field with global peers. It is noteworthy that the Indian stainless-steel producers are equipped to manufacture world-class products. Moreover, the currently installed production capacity is sufficient to meet the domestic demand of stainless-steel.

Therefore, the challenges faced by domestic players need to be addressed immediately by the government. We are providing all support to the government on behalf of the industry. We now expect a prompt action by the authorities.

|

First Ever Stainless Steel e-Rickshaw Prototype |

CE&CR: Please tell us about the increase in the use of stainless-steel as a building material in the last decade.

K K Pahuja: Stainless-steel is the new-age solution for a sustainable infrastructure. The Architecture, Building, and Construction (ABC) segment constitutes ~20% of the total Indian stainless-steel demand. Over the last decade, the demand for stainless-steel in India has grown at 8-9% per annum. The metal is a key raw material for modern day infrastructure projects like redevelopment of railway stations, new highways, and metro projects. Further, stainless-steel rebars and plates are essential components of modern-day foot overbridges (FOBs) and road-over-bridges (ROBs). Transit buildings such as airports and metro rapid mass transport systems have been extensively using this metal for various applications such as bollards, column claddings, ticketing counters, escalators, lifts, handrails, canopies, etc. Apart from this, stainless-steel is also a key ingredient for pipe and tube applications in railings, furniture, decorative items, facades, etc. In this background, the government’s continuous boost towards infrastructure and a lofty investment of nearly Rs. 35,000 crore for capacity expansion and modernization by the domestic industry have uplifted the stainless-steel demand prospects for infrastructural projects.

Stainless Steel for FOB Structures

CE&CR: Which segments do you see as growth drivers for the consumption of stainless-steel in the construction industry?

K K Pahuja: Cities in India are going through rapid urbanization with construction activities picking up. Stainless-steel demand is picking pace across segments such as hollowware, ABC segment, and railway infrastructures (like road-over- bridges, foot overbridges, benches, station redevelopment, etc.). The domestic players, along with ISSDA, have recently identified several key focus areas for stainless-steel usage to expand. Moreover, the promising National Infrastructure Pipeline project of the government is expected to harvest immense demand for stainless-steel on various fronts. Some of these are listed below:

- 65-70% requirement of energy infrastructure (including Thermal, Atomic, Renewable energy) in coastal areas will bank on stainless-steel for a sustainable and disaster-resilient setup.

- Demand from automobile segment for stainless-steel exhaust systems now that the BS VI norms have come into force from April 1, 2020.

- E-mobility market banks upon stainless-steel for effectively executing last mile connectivity transportation.

- The stainless-steel decorative pipes and tubes segment, currently growing at ~12% per annum, finds major applications in railings, furniture, decorative items, facades, etc.

- Stainless-steel is an effective and healthy alternative to the hazardous plastic for water solutions, leading to a better quality of life.

Stainless Steel for FOB Structures

CE&CR: Which segments do you see as growth drivers for the consumption of stainless-steel in the construction industry?

K K Pahuja: Cities in India are going through rapid urbanization with construction activities picking up. Stainless-steel demand is picking pace across segments such as hollowware, ABC segment, and railway infrastructures (like road-over- bridges, foot overbridges, benches, station redevelopment, etc.). The domestic players, along with ISSDA, have recently identified several key focus areas for stainless-steel usage to expand. Moreover, the promising National Infrastructure Pipeline project of the government is expected to harvest immense demand for stainless-steel on various fronts. Some of these are listed below:

- 65-70% requirement of energy infrastructure (including Thermal, Atomic, Renewable energy) in coastal areas will bank on stainless-steel for a sustainable and disaster-resilient setup.

- Demand from automobile segment for stainless-steel exhaust systems now that the BS VI norms have come into force from April 1, 2020.

- E-mobility market banks upon stainless-steel for effectively executing last mile connectivity transportation.

- The stainless-steel decorative pipes and tubes segment, currently growing at ~12% per annum, finds major applications in railings, furniture, decorative items, facades, etc.

- Stainless-steel is an effective and healthy alternative to the hazardous plastic for water solutions, leading to a better quality of life.